News for Subcontractor CIS Tax Refunds Clients & Accountancy Services Visitors

News Bites - Business, Individuals & Workplace

New 95% mortgage scheme launches

A new government-backed mortgage scheme will help first time buyers or current homeowners secure a mortgage with just a 5% deposit.

- 95% mortgage guarantee launches today, available on high streets across the country

- Scheme part of a range of ownership options to help make home ownership a reality

- New figures show demand for home ownership has soared during lockdown, with nearly 80% of private renters now saving for a deposit

- Today’s launch further strengthens government commitment to supporting the housing sector

A new government-backed mortgage scheme to help people with 5% deposits get on to the housing ladder is available to lenders from today (19 April 2021).

First announced at the Budget, the scheme will help first time buyers or current homeowners secure a mortgage with just a 5% deposit to buy a house of up to £600,000 – providing an affordable route to home ownership for aspiring home-owners.

The government will offer lenders the guarantee they need to provide mortgages that cover the other 95%, subject to the usual affordability checks.

The scheme is now available from lenders on high streets across the country, with Lloyds, Santander, Barclays, HSBC and NatWest launching mortgages under the scheme today and Virgin Money following next month.

The government has made clear its commitment to tackling inequality in the housing market and levelling up the country. Official statistics show more homes were delivered in 2020 than in any year since 1987.

In 2019 a pledge to build 300,000 new and attractive homes a year was announced with an investment of over £12 billion in affordable housing over the next 5 years – the largest investment in a decade.

Since 2010, more than 663,000 households have been helped into home ownership through government schemes, but when asked, 69% of private renters and 63% of those living at home who had looked into a mortgage said they cannot find many mortgages with a low deposit. Today’s new 95% mortgage scheme will now make it even more accessible to own a home.

Housing Secretary Rt Hon Robert Jenrick MP said:

For too many people, no matter how hard they work, home ownership can seem out of reach. One of the biggest divides in our country has been between those who can afford their own home and those who cannot.

That’s why we are determined to do everything we can to help hard-working families and prospective first-time buyers get their feet on the housing ladder in an easy and affordable way, to level up this country.

The new mortgage guarantee scheme which comes into effect today will give providers the confidence to lend and help families and young people get on the property ladder without the prohibitive burden of a large deposit.

Despite the challenges faced over the past year, the government has intervened to protect jobs, support builders and buyers to help keep the housing market healthy. Today’s 95% mortgages launch further strengthens our commitment to build back better from the pandemic.

In recent years we’ve reversed the trend and seen a positive increase in owner-occupiers. We’re determined to build on this through the range of flexible ownership options which help ensure home ownership is achievable. We want to match the ambitions of aspiring homeowners up and down the country.

Together we can turn ‘Generation Rent’ into ‘Generation Buy’.

Chancellor of the Exchequer, Rishi Sunak said:

Every new homeowner and mover supports jobs right across the housing sector, but saving for a big enough deposit can be hard, especially for first time buyers.

By giving lenders the option of a government guarantee on 95% mortgages, many more products will become available, boosting the sector, creating new jobs and helping people achieve their dream of owning their own home.

Miguel Sard, Managing Director of Home Buying and Ownership at NatWest said:

We welcome the government’s new mortgage guarantee scheme to give further support to those with smaller deposits. For those customers, particularly younger or first-time buyers, saving up for a big deposit can often be difficult, and we know people in these groups are some of the hardest hit by the effects of the pandemic.

A government-backed scheme will help segments of the market for whom home ownership has felt far out of reach in recent months.

Mark Hayward, Chief Policy Advisor at Propertymark, said:

Over the past few months, there has been an increase in the number of prospective buyers and the number of house sales taking place. Coupled with the decision to extend the Stamp Duty holiday further, the Mortgage Guarantee Scheme will provide additional options for more people to become homeowners.

Access to finance and affordability plays a key role in the ability for people to purchase their dream home, so we are now very pleased to see further support for both first-time buyers and current homeowners looking to buy property or move up the housing ladder.

The scheme is one of a range of flexible home ownership options available. These include Help to Buy, Shared Ownership and the First Homes Scheme. Figures show that the number of mortgage approvals for house purchases in January 2021 was 99,000 – a 40% increase on January 2020.

EU trade: training grants on the way

|

|

|

|

|

|

CMA provisionally clears merger of Virgin and O2

The CMA has provisionally cleared the proposed merger of Virgin Media and Virgin Mobile with O2.

Both Virgin and O2 provide certain wholesale services to other mobile network operators in the UK, as well as retail services to consumers. The CMA was clear at the outset of its in-depth inquiry that it was not concerned about overlapping retail services such as mobile, due to the small size of Virgin Mobile. It has therefore focused on whether the merger could lead to reduced competition in wholesale services as part of this review.

Virgin provides wholesale leased lines to mobile telecommunications companies, such as Vodafone and Three, which they use to connect key parts of their network. This is often referred to in the industry as ‘backhaul’. Similarly, O2 offers mobile operators such as Sky and Lycamobile, which do not have their own mobile network, use of the O2 network to provide their customers with mobile phone services.

The CMA was initially concerned that, following the merger, Virgin and O2 could raise prices or reduce the quality of these wholesale services, or withdraw them altogether. If this were to happen, the quality of these other companies’ mobile services could suffer and – if wholesale price increases were passed on by these companies to their customers – their retail prices could go up. This might make Virgin and O2’s own mobile service comparatively more attractive to retail customers, but would ultimately lead to a worse deal for UK consumers.

These concerns led to the merger being referred to a group of independent CMA Panel members for an in-depth Phase 2 investigation.

Having examined the evidence, the CMA inquiry group has now provisionally concluded that the deal is unlikely to lead to any substantial lessening of competition in relation to the supply of wholesale services for several reasons:

-

Backhaul costs are only a relatively small element of rival mobile companies’ overall costs, so it is unlikely that Virgin would be able to raise backhaul costs in a way that would lead to higher charges for consumers.

- There are other players in the market offering the same leased-line services, including BT Openreach - which has a much greater geographical reach than Virgin - and other smaller providers. This means the merged company will still need to maintain the competitiveness of its service or risk losing wholesale custom.

- As with leased-line services, there are a number of other companies that provide mobile networks for telecoms firms to use, meaning O2 will need to keep its service competitive with its wholesale rivals in order to maintain this business.

Martin Coleman, CMA Panel Inquiry Chair, said:

Given the impact this deal could have in the UK, we needed to scrutinise this merger closely.

A thorough analysis of the evidence gathered during our phase 2 investigation has shown that the deal is unlikely to lead to higher prices or a reduced quality of mobile services – meaning customers should continue to benefit from strong competition.

More information is available on the Liberty Global plc / Telefónica S.A. merger inquiry case page.

New tools to prevent, reduce and manage stress in the workplace

Employers are being urged to review the stress-causing factors in their workplaces and the work that their employees do.

Stress, depression or anxiety account for 51% of all work-related ill health cases and 55% of all working days lost due to work-related ill health. Stress impacts on all sectors and businesses of all sizes and employers have a legal duty to protect employees from stress at work by doing a risk assessment and acting on it.

Evidence shows that there are six key factors which, if not properly managed, are associated with poor health, lower productivity and increased accident and sickness absence rates.

The six key factors are:

- Demands: workload, work patterns and the work environment

- Control: how much say the person has in the way they do their work

- Support: encouragement, sponsorship and resources available to workers

- Relationships: promoting positive working to avoid conflict and dealing with unacceptable behaviour

- Role: whether people understand their role within the organisation and whether the organisation ensures that they do not have conflicting roles

- Change: how change (large or small) is managed and communicated.

Rob Vondy, Head of Stress and Mental Health Policy at HSE, says: “It’s well known that stress can make you ill. We know that work-related stress depression and anxiety has increased in recent years, and the last year has presented new challenges that have never been faced before, and which may affect the workplaces of the UK for some time to come.

“Good communication is vital as stress affects people differently – what stresses one person may not affect another. If you don’t understand the problem or its extent, tackling it will be more difficult. Factors like skills and experience, age or disability may all affect whether an employee can cope. People feel stress when they can’t cope with the pressures or demands put on them, either in work or other outside issues. Start talking to your colleagues about any issues now – the earlier a problem is tackled the less impact it will have.

“Employers should match demands to employees’ skills and knowledge. Recognising the signs of stress will help employers to take steps to prevent, reduce and manage stress in the workplace. Healthy and safe work and workplaces are good for business and good for workers.”

HSE has a range of practical support and guidance available including risk assessment templates, a talking toolkit to help start conversations, workbooks, posters, a new mobile app and a new automated stress indicator tool (SIT). For more information see the stress section at www.hse.gov.uk

£280m capital funding boost for children and young people with SEND

Investment will provide more specialist places and improve provision for SEND pupils across country

Children with special educational needs and disabilities (SEND) or requiring alternative provision in England will benefit from a £280 million investment, the government has announced today (09 April).

Councils will receive the funding to create new places in schools, academies, colleges and early years settings. The funding will improve existing provision to create modern, fit-for-purpose spaces suited to a wider range of pupil needs. This could be by contributing to the cost of creating a whole new special school, or by improving accessibility, such as installing ramps, handrails or ceiling hoists.

The funding is part of the government’s commitment to ensuring pupils with SEND receive the specialist support they need to get an excellent education.

Minister for the School System Baroness Berridge said:

It is so important that all children and young people, whatever their background, are able to attend a good school that helps them thrive and gives them the building blocks they need to go on to fulfil their potential.

For pupils with more complex needs or disabilities, it is especially important that the right facilities and support are in place at whatever school they attend, so they can learn in a modern, adaptable environment.

This funding will help councils provide targeted support to level up outcomes for some of their most vulnerable pupils.

The allocations announced today build on the government’s continued investment in the Free Schools programme. 59 special and 49 Alternative Provision free schools have already opened across the country since 2010, and more than 80 specialist settings or alternative provision projects are set to open in the coming years.

The investment, which represents a significant single-year increase in high needs capital investment, follows £365 million allocated through the Special Provision Capital Fund to create places and improve facilities for pupils with SEND across 2018 to 2021.

Children and Families Minister Vicky Ford said:

Every child or young person with SEND should go to school feeling confident that they will get the tailored support they need at school, and every teacher should be equipped with the right facilities to teach those pupils.

We have already increased the high needs budget by nearly a quarter over the past two years. This additional investment will enable local authorities to invest more in creating excellent school places or enhancing existing provision so that pupils with additional needs and disabilities get the same opportunities as any other.

The funding adds to the Government’s programme of work to level up outcomes, including the ongoing SEND Review which is looking at ways to make sure the system is consistent, high-quality and integrated across education, health and care.

The funding is for the financial year 2021-22, to support the provision of high needs places needed by September 2022. Up to an additional £20 million will be used to support High Needs capital projects in a small number of the local authorities facing the highest Dedicated Schools Grant deficits.

Professor Adam Boddison, Chief Executive of NASEN, said:

Given the growing demand for high-quality specialist provision, this increase in high needs funding is a welcome investment. I hope that Local Authorities will work in partnership with schools, specialist settings and families so that this funding is targeted to secure long term benefits for learners with SEND.

Graham Olway MBE, National Chairman of the Education Building Development Officers Group, said:

We welcome this announcement of extra High Needs funding to help support the work of local authorities in meeting the needs of children with a range of needs in schools. The funding allows more opportunities and projects to be fulfilled in an area of growing need for local authorities.

Visas extended for thousands of frontline health and care workers

Extension to benefit 14,000 applicants.

Thousands of crucial frontline health workers and their dependents will be granted free visa extensions, Home Secretary Priti Patel has announced today.

Free one-year visa extensions will be automatically granted to eligible overseas health and care workers whose visas were due to expire before 1 October 2021.

Since starting the free extensions last year, the Home Office has extended the visas of more than 10,000 people across the UK. It is expected that today’s announcement will benefit a further 14,000 applicants.

This will mean that doctors, nurses, paramedics, midwives, occupational therapists, psychologists and others will be able to continue their crucial work in the fight against coronavirus.

Home Secretary Priti Patel said:

The dedication and skill of overseas health and care workers who are leading the UK’s fight against coronavirus is truly extraordinary.

Thousands of them have helped save countless lives throughout this pandemic and are now playing a vital part in the hugely successful vaccination rollout.

Our offer of free visa extensions shows how our country values the contributions of these heroes.

Secretary of State for Health and Social Care Matt Hancock said:

Our overseas health and care workers make such a vital contribution to our health system and have been a key part of fight against the pandemic. They are protecting our loved ones and vaccinating the public so that we can save lives and return to normality.

To help those staff from overseas, we are extending their visas to provide security while they continue to tackle this virus.

This extension will cover healthcare professionals working in the NHS and the independent health and care sector. Their visas will be extended for a year, free of all fees and charges, including the Immigration Health Surcharge.

Those benefiting from this extension will need to complete a simple online form to verify their identity. We will also ask their employers to confirm their eligibility.

The government is committed to continuing to support overseas health and care workers and make it as easy as possible for talented people wanting to work in the sector to come to the UK.

Our Health and Care Visa, which launched last August, makes it easier, cheaper and quicker for the best global health professionals to work in the NHS, the social care sector and for those organisations which provide commissioned services to the NHS. On 29 January, we expanded the list of occupations which are eligible to benefit from the Health and Care Visa.

So far more than 20,000 people have been granted a visa through the route.

Last year we expanded the Bereavement Scheme to all NHS, health and social care workers and continue to encourage healthcare workers who are EU, other EEA or Swiss citizens, or their family members to apply to the EU Settlement Scheme, to secure their rights in UK law.

Cutting edge technology on right track to improve tyre safety

Cutting edge technology that monitors tyre pressures, tread depth and the axle weight of HGVs has been hailed for its potential in boosting safety on the roads.

Cutting-edge technology comprising a set of high-intensity strobe lights, all-weather cameras and drive-over pressure instruments monitor tyre pressures, tread depth and the axle weight of HGVs.

Trials, funded by Highways England’s designated fund for innovation, have proved hugely successful with one in 12 of 100,000 tyres checked found to be underinflated and the Driver and Vehicle Standards Agency (DVSA) identifying 5,000 overweight vehicles a month.

Now there are plans to roll the system out at strategic route locations across the country.

Highways England’s Commercial Vehicle Incident Prevention Team (CVIPT) backed a pilot of the sophisticated WheelRight quartz senor system at Keele Services on the M6 before running year-long trials with John Lewis at Milton Keynes, AW Jenkinson Transport at Penrith, and the DVSA check site at Cuerden, on the M62.

The system comprises a set of high-intensity strobe lights, all-weather cameras and drive-over pressure instruments – all collecting huge amounts of data within seconds which allows for adjustments to be made to ensure that tyres are compliant with safety standards.

This data is analysed to provide results instantly and reports include: tyre pressures (pass or fail based on predetermined levels); tread depths (pass or fail based on specified levels); tyre temperatures (early identification of problem tyres or wheels); tyre condition (via a 360o photographic image of the tread); and Weigh in Motion data/axle weights.

CVIPT, who championed the ground-breaking system along with a host of other commercial vehicle safety initiatives, scooped Highways England Chairman’s Award and the Excellence in Safety Innovation Award. The team was one of 30 winners rewarded at the third Highways England Awards, designed to recognise activities which further the company’s imperatives of safety, customer service and delivery. This year the award ceremony was held online.

Individuals and teams from within Highways England as well as its supply chain partners were among those recognised in the awards.

Environmental management services company fined after worker fatally crushed

An environmental management services company has been fined after a worker was fatally injured by a reversing vehicle.

31 March 21. Northampton Crown Court heard how on 8 April 2016, an employee of Enterprise Managed Services Limited was fatally crushed when he tripped and fell under the wheels of the refuse lorry in Ashby Road, Daventry whilst on a routine collection of recyclable refuse.

An investigation by the Health and Safety Executive (HSE) into the incident found that a suitable and sufficient risk assessment had not been carried out for the collection route and there was a failure to adequately supervise the Daventry waste and recycling round.

Enterprise Managed Services Limited of the Chancery Exchange, Furnival Street, London pleaded guilty to breaching Section 3(1) of the Health & Safety at Work etc Act 1974. They have been fined £1,020,000 and ordered to pay costs of £60,476.

Speaking after the hearing, HSE inspector Michelle Morrison said: “This tragic incident led to the death of a young man, which could so easily have been avoided by simply carrying out a suitable and sufficient route risk assessment and identifying where reversing could be avoided.

“Those in control of workplaces are responsible for identifying and implementing suitable methods of working to reduce the need for vehicle reversing.

“Companies should be aware that HSE will not hesitate to take appropriate enforcement action against those that fall below the required standards”.

School fined after member of the public sustains fatal head injury in fall

A school has been fined after a member of public tripped over a retaining wall and sustained a fatal head injury.

31st March 2021

Peterborough Magistrates’ Court heard how on 17 February 2017, a family member attended The Leys & St Faith’s Foundation School in Cambridge to watch an evening

performance. While walking towards the hall the woman tripped over a small retaining wall and fell to the ground sustaining a serious head injury. She died six days later in hospital.

An investigation by the Health and Safety Executive (HSE) found that The Leys & St Faith’s Foundation School had failed to ensure the area was adequately lit. A

pedestrian site safety assessment failed to identify the risk of tripping over the wall and did not take into consideration the lighting conditions or potential effect of poor lighting on pedestrian

safety at night.

The Leys and St Faith’s Foundation School of Fenn Causeway, Trumpington Road, Cambridge pleaded guilty to breaching Section 3 (1) of the Health and Safety at Work Act 1974. They were fined of £52,800

and ordered to pay costs of £10,040.

Speaking after the hearing, HSE inspector Graham Tompkins said: “This tragic incident was easily preventable, and the risk should have been identified.

“The school should have taken measures to improve lighting and install a handrail on top of the wall to increase the overall height.”

Jail sentence for businessman who filled former quarry with dangerous waste

A rogue trader has been jailed for allowing thousands of tonnes of waste - including hazardous material - to be illegally deposited at a site in Somerset.

Mark Foley, of Cardiff, was jailed for 2 years and 3 months for illegally disposing of 100,000 tonnes of waste at Stowey Quarry, a former limestone quarry near Chew Valley reservoir. The offence happened within the first nine months of 2016, sparking an intensive investigation by the Environment Agency into the management of the site.

The illegal operation, which accepted waste from around England, was described at Bristol Crown Court as one of the most serious risks of harm in the country during the past 30 years. Foley was also jailed for a further 18 weeks, to be served concurrently, for supplying false information to the Environment Agency.

Foley’s firm, M E Foley (Contractors) Ltd, which ran the site under an environmental permit, failed to provide the court with any company accounts and was fined £72,000.

Rebecca Kirk of the Environment Agency said:

It has taken 3 years of meticulous work for our investigation into Stowey Quarry to reach this stage. This was environmental offending of the highest order.

I am pleased the judge acknowledged the seriousness of the offences committed and this is reflected in the sentences being handed down to those who orchestrate and take advantage of such criminal practice and show a blatant disregard to the environment and public health.

Stowey Quarry was only permitted to accept ‘clean’ and ‘non-hazardous’ material including soil and construction waste for recovery purposes – to build bunds and embankments in the quarry. Foley, as the site operator, was responsible for checking waste arriving at the site to ensure it was suitable. An investigation showed the rules were routinely flouted.

Despite repeated warnings, the illegal tipping and waste disposal continued and in October 2016 the Environment Agency served M E Foley (Contractors) Ltd with a Suspension Notice that cancelled its permit with immediate effect and stopped the site from operating.

The Environment Agency launched an investigation to establish the potential risk to human health and the environment from the illegal waste activities at the site. Samples taken from trial pits and bore holes revealed a high percentage of chopped/shredded plastics, metals, foam and other man-made materials. Analysis showed that about half the samples were hazardous and either carcinogenic or ecotoxic.

The investigation included the monitoring of landfill gases and sampling of nearby streams that showed an elevated concentration of gases together with leachate breaking out onto the surface of some surrounding fields.

Much of the waste arriving at Stowey Quarry was misleadingly described as a ‘soil substitute’ in a deliberate attempt to circumvent the rules. The storage and disposal of hazardous material contravened the site’s permit that only allowed clean/inert waste.

Not only was the site dishonestly accepting the wrong type of waste, the operator was also lying about the amount being received. After checking waste transfer notes provided by the waste producers and hauliers, it is estimated that in 2016 alone, almost 95,000 tonnes of waste was deposited at Stowey Quarry - double the 44,950 tonnes declared by M E Foley (Contractors) Ltd.

The investigation also questioned the true amount of waste received by the site since its operation began in 2012. The amount deposited at the site by 2016 was closer to 200,000 tonnes – well above the 65,000 tonnes Foley was permitted to store for the purpose of restoring perimeter bunds and embankments using clear, inert waste.

Further defendants in the case will be sentenced in July at Bristol Crown Court and hearing dates for proceeds of crime proceedings have been set.

Refusing to return after lockdown

|

|

|

|

|

|

Behaviour experts to support schools with poor discipline

School leaders with outstanding records on behaviour selected to support other schools as part of £10 million Behaviour Hubs programme

Heads and behaviour leads from some of England’s highest performing schools and Multi Academy Trusts (MATs) have today been confirmed as mentors and trainers in the Department’s £10 million Behaviour Hubs programme.

Designed to support schools struggling with poor discipline, training through the Behaviour Hubs for the first group of participating schools will commence from the start of the summer term, at a time when a minority of pupils may need extra support from their schools to re-engage with education following the pandemic.

The lead schools and MATs will work closely with the schools they are supporting to diagnose what could be improved, develop and launch new behaviour approaches and policies and provide ongoing mentoring and support.

The lead schools selected have shown that good discipline overwhelmingly results in the best Ofsted ratings and overall outcomes for their students, and have demonstrated their capacity to support other schools to achieve the same.

Lead schools will advise their counterparts on issues ranging from setting clear expectations to eliminate low-level disruption in classrooms that is so damaging to teachers and other pupils, to more systematic approaches to maintaining order and discipline across the school, such as forbidding the use of mobile phones and maintaining quiet corridors.

HMRC warning over Class 2 NI

|

|

|

|

|

| Courtesy of Tips & Advice Tax |

Hundreds of free qualifications on offer to boost skills and jobs

Launch of free qualifications marks a major milestone in government’s Lifetime Skills Guarantee

An estimated 11 million adults now have the opportunity to gain a new qualification for free, designed to help them to gain in-demand skills and secure great jobs.

Almost 400 qualifications are available to take from today (1 April) - backed by £95 million in government funding in 2021/22 - as part of the government’s Lifetime Skills Guarantee.

The qualifications on offer range from engineering to social care to conservation and are available to any adult who has not already achieved a qualification at Level 3 (equivalent to A-levels).

The roll out marks a major milestone in the delivery of the landmark Lifetime Skills Guarantee - announced by the Prime Minister in September 2020. The Guarantee aims to transform the skills system so everyone, no matter where they live or their background, can gain the skills they need to progress in work at any stage of their lives. It will also ensure employers have access to the skilled workforce they need, and more people are trained for the skills gaps that exist now, and in the future.

Adults who take up the free courses have the potential to boost career prospects, wages and help fill skills gaps, while supporting the economy and building back better.

For example, with a Diploma in Engineering Technology adults can progress to roles in Maintenance or Manufacturing Engineering. A Level 3 Diploma in Electrical Installation or a qualification in Adult Care can also provide a gateway to sectors offering rewarding careers and where there are multiple job opportunities.

So more unemployed people can take full advantage of these courses, the government will pilot an extension to the length of time they can receive Universal Credit while undertaking work-focused study.

They will now be able to train full time for up to 12 weeks, or up to 16 weeks on a full time skills bootcamp in England, while receiving Universal Credit to support their living costs This will allow access to more training options and provide a better chance of finding work, while continuing to receive the support they need.

Paid time off for the vaccine?

|

|

|

|

Two construction companies fined after working platform failed

Two construction companies have today 17/03/21 been sentenced following an incident where a working platform failed and a bricklayer using the platform was injured.

Durham Crown Court heard how, on 1 July 2019, Dere Street Homes Limited were acting as principal contractor and provided components for a proprietary polypropylene working platform at a new build at Marley Fields, Wheatley Hill, County Durham. SGS Construction & Design Limited were acting as a contractor and supplied workers to erect the working platform. The working platform failed and a worker was injured.

An investigation by the Health and Safety Executive (HSE) found that a number of components were missing from the working platform. Although previously workers supplied by SGS were formally trained in the erection of the components to form a safe working platform, the worker who erected the failed platform had not received adequate training. The signing off as a safe working platform had earlier been undertaken by a site manager working for Dere Street Homes. When this manager left, a number of months prior to the incident, the inspection and signing off of the working platform was no longer undertaken.

Dere Street Homes Limited of The Farm House, Hedley Hill Farm, Cornsay Colliery, County Durham pleaded guilty to breaching Regulation 13(1) of the Construction (Design & Management) Regulations and was fined £38,000 and ordered to pay costs of £5,367.30.

SGS Construction & Design Limited of Laburnum Avenue, Blackhill, Consett, County Durham pleaded guilty to breaching Regulation 15(2) of the Construction (Design & Management) Regulations and was fined £8,000 and ordered to pay costs of £2,683.60.

After the hearing, HSE principal inspector Rob Hirst commented: “Although the worker did not suffer life changing injuries, there was a potential for more serious injury.

“Those in control of work have a responsibility to ensure that workers are adequately trained, properly supervised, and work activities are appropriately monitored.”

Plant hire company sentenced following fatal incident at construction site

Specialist plant hire company, Ruislip Plant Ltd, has today 15/03/21 been fined after a worker was fatally injured whilst undertaking maintenance on a piling rig.

Reading Crown Court heard that, on 13 May 2014, Ben Wylie, was assisting the Ruislip Plant Ltd Director Mr Noel Kearney (since deceased) with the maintenance of a high-pressure grease track adjusting mechanism at a construction site in West Street, Maidenhead. During the process, the grease nipple assembly and a stream of high-pressure grease was forcibly ejected from the mechanism and struck Ben Wylie in the shoulder and chest causing fatal injuries.

An investigation by the Health and Safety Executive (HSE) found that the components had been forcibly ejected on the previous day and had sustained damage in that event, reducing the pressure at which it would subsequently fail. Once the fitting had been ejected, it should not have been refitted. Despite the fittings having been previously ejected and damaged, Mr Kearney attempted to modify and refit the grease nipple and adaptor to the high-pressure system. He then began to re-pressurise the tracks by pumping in grease using a hand operated grease gun. The pressure built in the system and at a critical point the damaged and modified components were again ejected. A pressure test with all suitable safeguards was required in these circumstances but there was no safe system of work during which resulted in the modifications to the grease gun bringing Ben Wylie into the danger zone.

Ruislip Plant Ltd of Lea Crescent, Ruislip, Middlesex pleaded guilty to breaching Section 3(1) of the Health & Safety at Work etc. Act 1974. The company has been fined £99,000 and ordered to pay costs of £116, 973.36.

After the hearing, HSE inspector John Glynn said: “HSE guidance is very specific on how this work should be undertaken and previously ejected or damaged parts must not

be reused as they were in this case.

“This incident could have been avoided if Ruislip Plant Ltd had instead undertaken a risk assessment and devised a safe system of work. That safe system of work would necessarily have ensured that

new parts were used, and that the safety procedure of a pressure test was performed. However, a new component was not used in this incident and the safety procedure was not adhered to.

“That failure to adhere to the correct procedure for pressure testing was directly causative of this incident. No control measures were put in place by Ruislip Plant Limited and that sadly led to the death of Ben Wylie.”

Property developers abuse millions of investor funds

Property Directors banned for 25 years after abusing £7.7million taken from investors for student accommodation never completed.

Sanjiv Varma (57) and Jonathan England (48), were directors of property firm Grosvenor Property Developers Ltd. The company sold student accommodation in Bristol off-plan and collected more than £7.7million from investors between February 2017 and January 2018.

The student accommodation, however, was never completed by Grosvenor Property Developments and investors applied for the liquidation of the company in November 2018.

Grosvenor Property Developers was wound-up in court on 14 November 2018 and the Official Receiver was appointed as liquidator, which triggered investigations into the conduct of the directors of the property firm.

Enquiries established that funds were diverted into accounts belonging to or companies connected to Sanjiv Varma. £3.1million was paid to another company in Dubai also owned by the director.

Sanjiv Varma used at least £1.3million to fund travel, gifts and designer clothing.

Investigators also found that planning permission was never applied for and titles to the property were never acquired by Grosvenor Property Developers.

Sanjiv Varma has been banned as a company director for 13 years, while his fellow director, Jonathan England, has been disqualified for 12 years.

In their undertakings to the Secretary of State, the directors did not dispute that they caused and/or allowed Grosvenor Property Developers Ltd to misappropriate investor deposits of more than £6.5million.

Both bans were effective from 22 February 2021 and the pair are banned from directly or indirectly becoming involved, without the permission of the court, in the promotion, formation or management of a company.

Karen Maxwell, Deputy Chief Investigator at the Insolvency Service, said: “Sanjiv Varma and Jonathan England fabricated an extensive renovation project to create student accommodation in Bristol, taking large deposits from investors with the promise of a high quality asset.

“Instead, Sanjiv Varma took millions from the company and Jonathan England did nothing to stop his co-director from spending their funds on international flights and designer clothing. Both have now been disqualified as company directors for a significant time period.”

Seasonal workers to receive free Covid-19 tests on farms

Employers of seasonal agricultural workers in the edible horticulture sector urged to register for free workplace testing

The government has today (29 March) called on employers of seasonal agricultural workers to help keep the nation safe and restrict the spread of Covid-19 by registering for free workplace testing.

This follows the introduction of a new bespoke testing regime for international arrivals this weekend, 27/03/21 which extended the supply of free Lateral Flow Device (LFD) tests to employers of seasonal agricultural workers in the edible horticulture sector. These workers play a vital role across many of our farms, picking fruit and vegetables and helping to feed the nation.

Under this new bespoke testing regime, international arrivals who are in the country for longer than two days will be required to take a test before the end of day two and to take a further test every three days – typically on days five and eight. Those who receive a positive test result will be required to take a further PCR test for variant surveillance.

Seasonal agricultural workers will be able to access these tests through several routes, including home tests and community testing sites. They should remain on the farm for the 10 days after they arrive, except where necessary to access testing.

Employers of seasonal agricultural workers who register for workplace testing can now access free tests to help meet this testing requirement, which will protect growers from having to take on the greater costs of regular PCR testing, which could save an estimated £10m for growers across the country.

Farming Minister Victoria Prentis has written to employers of seasonal workers today, encouraging them to take up this offer and register to deliver regular testing of their workers. Around 1 in 3 people with coronavirus don’t have symptoms, so workplace testing will help to identify individuals who may be carrying the virus without knowing it, and allow employers to take the necessary action to stop the virus spreading amongst their workforce.

Writing to growers across the country today, Farming Minister Victoria Prentis said:

I am immensely grateful for the resilience our growers have shown throughout the last year, meeting the challenges of the pandemic and going above and beyond to help keep the nation fed.

Now, as we look towards resuming a more normal way of life, we must stay vigilant and do what we can to ensure we continue to operate as safely as possible.

Regular testing protects businesses, helps keep workers safe and is vital to our continuing recovery. I urge our farmers and growers to work with us to protect their workforces, their businesses and our food supply.

The tests can be carried out at a designated workplace site, and for businesses of over 10 people, employers can dispense those tests for staff to take at home. If positive results come back, staff must take swift action to isolate and undertake a confirmatory Polymerase Chain Reaction (PCR) test.

In addition, those overseas looking to work within the edible horticulture sector will be able to undertake the mandatory two week quarantine period on the farm, meaning they can carry out certain tasks under Covid-safe conditions during that time. This has already proved to be vitally important for the sector, with government taking action to ensure that pickers were able to get straight to work gathering last year’s harvest.

Employers must register for the programme by the 12 April to receive a supply of free test kits until the end of June.

Bespoke testing regime unveiled for exempt international arrivals

The UK government has today (Sunday 28 March) set out new details of a bespoke testing regime for international arrivals who will be exempt from quarantine for work purposes, including for hauliers arriving from outside the Common Travel Area into England.

- Government publishes details of tailored testing system for professions exempt from quarantine rules

- New regime will commence on 6 April and use lateral flow tests to rapidly identify cases coming into the UK

- Limited number of professions will be exempt from quarantining in order to keep freight and other crucial industries moving freely

Earlier this year the government strengthened its border regime, putting new controls in place to protect the UK from the spread of COVID-19 and new variants entering. From 6 April bespoke testing will be made available to certain professions to enable them to carry out their roles whilst providing an additional layer of protection to help ensure positive cases are detected.

Under this new bespoke testing regime international arrivals who are in the country for longer than two days will be required to take a test before the end of day two. People will be able to access these tests through several routes, including home tests and community testing sites. Those remaining in the UK for any longer than 2 days will then be required to take a further test every 3 days – typically on days 5 and 8.

If people working in these sectors are staying for two days or fewer you are not required to take tests. You may be required to complete a pre-departure test, even if you have an exemption from quarantine. International arrivals travelling outside the Common Travel Area daily must complete and submit a lateral flow test at least once every 3 days.

The professions exempt from quarantining and able to access bespoke testing are:

- Hauliers

- Border security duties (UK officials and contractors)

- International prison escorts

- Aircraft crew and pilots

- Aerospace engineers

- Channel tunnel system workers

- International rail crew, passenger and freight operations (Eurostar, Eurotunnel, Network Rail and high-speed rail workers)

- Seafarers and masters

- Essential defence activity (in scope are defence personnel, both military and civilian; visiting forces; and defence contractors

- Persons transporting human blood, blood components, organs, tissues or cells

- Seasonal agricultural workers

These tests will be available through a number of routes including:

- workplace testing programmes available to employers

- community testing programmes offered by all local authorities in England

- at home, by collecting lateral flow self-test kits at community sites, ordering test kits online or by dialling 119

- for hauliers, at the network of dedicated testing sites across the strategic road network (as well as the methods outlined above)

If an individual tests positive with a lateral flow test, they will be required to take a confirmatory PCR test. A subsequent positive PCR test will be sent for genomic sequencing, to detect variants of concern. The individual will be required to self-isolate for 10 days from the day after the test was taken.

Swift detection of cases means those who test positive can quickly isolate and, in doing so, break chains of transmission and suppress the virus.

Some exempt professions are required to still do day 2 and day 8 PCR tests if their travel is intermittent but will not have to quarantine.

These professions are:

- Border Security Duties (non-UK officials and contractors)

- Regular work abroad

- Civil aviation inspectors

- Bus and coach drivers

- Crown Servants and Government Contractors that meet the required criteria as persons undertaking or facilitating essential government work/essential state business

- Elite sportspeople – international and domestic

- Representatives of a foreign country or territory or British Overseas Territories

- Oil and gas workers

- Nuclear personnel

- Specialist technical workers, postal workers and telecoms workers

- Sponsors of clinical trials

All international arrivals not employed in these professions, fishers or diplomats will be required to quarantine for 10 days – either at home or in a managed quarantine hotel – and follow the mandatory testing regime of taking a Covid-19 test on or before day 2 and on or after day 8 of quarantining.

Anyone coming into the UK and found to not be complying with the new testing requirements could face fines of up to £2,000.

Haulier testing

From 6 April, new testing requirements will be introduced for hauliers entering England from abroad, to help reduce the risk of new COVID-19 variants entering the UK.

Mental health recovery plan backed by £500 million

The government's mental health recovery action plan will support hundreds of thousands of people with mental health issues.

People with mental health difficulties, ranging from severe mental illnesses such as bipolar and schizophrenia, to those with more common mental health issues, including anxiety and depression, will benefit from expanded mental health services backed by £500 million as part of the government’s Mental Health Recovery Action Plan.

The plan, published today 27th March 2021, aims to respond to the impact of the pandemic on the mental health of the public, specifically targeting groups which have been most impacted including those with severe mental illness, young people, and frontline staff.

Under the plan NHS talking therapies (IAPT services) which offer confidential treatment of conditions such as anxiety, depression and PTSD will expand, supporting 1.6 million people to access services in 2021/22, backed by an additional £38 million.

Additional therapists will also be trained to support those with more complex mental health needs as a result of the pandemic.

People living with severe mental illness will also benefit from enhanced mental services in the community, backed by £58 million for better, joined up support between primary and secondary care, including specialist mental health staff embedded in primary care. The funding will accelerate expansion and transformation of community mental health services, enabling people with severe mental illnesses to access psychological therapies, improved physical health care, employment support, personalised and trauma-informed care, medicines management and support for self-harm.

This is part of the wider government agenda to build back better from the pandemic and ensure everyone is able to access the support they need.

North Sea deal to protect jobs in green energy transition

High-skilled oil and gas workers and the supply chain will not be left behind in transition to low carbon future as landmark North Sea Transition Deal is agreed with industry.

- UK becomes first G7 country to agree a landmark deal to support the oil and gas industry’s transition to clean, green energy - while supporting 40,000 jobs

- from 31 March 2021, the UK will no longer provide financial support for the fossil fuel energy sector overseas

- UK government sets standard to transition to clean, green economy as we build back better - without leaving communities and vital industries behind

High-skilled oil and gas workers and the supply chain will not be left behind in the transition to a low carbon future, the UK government vowed today (Wednesday 24 March) as a landmark North Sea Transition Deal is agreed with industry.

The sector deal between the UK government and oil and gas industry will support workers, businesses, and the supply chain through this transition by harnessing the industry’s existing capabilities, infrastructure and private investment potential to exploit new and emerging technologies such as hydrogen production, Carbon Capture Usage and Storage, offshore wind and decommissioning.

Through the deal, the oil and gas sector, largely based in Scotland and the North East, government and trade unions will work together over the next decade and beyond to deliver the skills, innovation and new infrastructure required to decarbonise North Sea production. Not only will the deal support existing companies to decarbonise in preparation for a net zero future by 2050, but it will also create the right business environment to attract new industrial sectors to base themselves in the UK, develop new export opportunities for British business, and secure new high-value jobs for the long-term.

Extracting oil and gas on the UK Continental Shelf is directly responsible for around 3.5% of the UK’s greenhouse gas emissions. Through the package of measures, the deal is expected to cut pollution by up to 60 million tonnes by 2030 including 15 million tonnes from oil and gas production on the UK Continental Shelf - the equivalent of annual emissions from 90% of the UK’s homes - while supporting up to 40,000 jobs across the supply chain.

Key commitments in the North Sea Transition Deal include:

- the sector setting early targets to reduce emissions by 10% by 2025 and 25% by 2027 and has committed to cut emissions by 50% by 2030

- joint government and oil and gas sector investment of up to £16 billion by 2030 to reduce carbon emissions. This includes up to £3 billion to replace fossil fuel-based power supplies on oil and gas platforms with renewable energy, up to £3 billion on Carbon Capture Usage and Storage, and up to £10 billion for hydrogen production

- by 2030, the sector will voluntarily commit to ensuring that 50% of its offshore decommissioning and new energy technology projects will be provided by local businesses, helping to anchor jobs to the UK

- the appointment of an Industry Supply Chain Champion who will support the coordination of local growth and job opportunities with other sectors, such as Carbon Capture Usage and Storage and offshore wind

An orderly transition is crucial to maintaining our energy security of supply, supporting high-value jobs, and safeguarding the expertise necessary to achieve a lower carbon future.

The UK government will therefore introduce a new Climate Compatibility Checkpoint before each future oil and gas licensing round to ensure licences awarded are aligned with wider climate objectives, including net-zero emissions by 2050, and the UK’s diverse energy supply. This Checkpoint will use the latest evidence, looking at domestic demand for oil and gas, the sector’s projected production levels, the increasing prevalence of clean technologies such as offshore wind and carbon capture, and the sector’s continued progress against its ambitious emissions reduction targets.

The UK government believes it is vital that any future licenses are granted to industry only on the basis that they are compatible with the UK’s climate change objectives. A dynamic checkpoint enables the assessment of ongoing domestic need for oil and gas, while expecting concrete action from the sector on decarbonisation. If the evidence suggests that a future licensing round would undermine the UK’s climate goals or delivery of Net Zero, it will not go ahead. The UK government will design and implement the checkpoint by the end of 2021 through extensive engagement with a wide range of stakeholders.

In a further move to support the shift to green technology and renewable energy in the UK and around the world, the UK government has announced it will no longer provide support for the fossil fuel energy sector overseas from 31 March 2021. This follows the Prime Minister’s commitment to end taxpayer support for fossil fuels projects overseas as soon as possible at the Climate Ambition Summit last December and the decision on the date to end this comes after consultation with industry. This will include UK Export Finance support, international aid funding, and trade promotion for new crude oil, natural gas and thermal coal projects - with very limited exceptions.

Business and Energy Secretary Kwasi Kwarteng said:

Today, we are sending a clear message around the world that the UK will be a nation of clean energy as we build back better and greener from the pandemic.

We will not leave oil and gas workers behind in the United Kingdom’s irreversible shift away from fossil fuels. Through this landmark sector deal, we will harness the skills, capabilities and pent-up private investment potential of the oil and gas sector to power the green industrial revolution, turning its focus to the next-generation clean technologies the UK needs to support a green economy.

At every step on the path to net zero emissions, we will create the right conditions for new green industries to base themselves in the UK and create new high-value employment opportunities, while future-proofing existing businesses to secure the long-term viability of jobs in our industrial heartlands.

The offshore oil and gas industry has been a major British industrial success story. For decades, the sector has strengthened our energy security, generated significant tax revenue to fund our public services, and supported hundreds of thousands of jobs across the UK. From the Shetland Islands and Aberdeen, to Teesside and the Humber, the industry is critical to the health of local economies.

Oil and gas is still vital to the production of many everyday essentials like medicines, plastics, cosmetics and household appliances - this is likely to remain the case over the coming decades as the UK transitions to low carbon solutions. Indeed, the government’s independent Committee on Climate Change recognises the ongoing demand for oil and natural gas, including it in all scenarios for how the UK meets its target for achieving net zero emissions by 2050.

Spot checks and inspections on businesses are taking place in Manchester

The Health and Safety Executive (HSE) is working with Manchester City Council to carry out spot check calls, visits and inspections on businesses in Manchester city centre to check they have COVID-secure measures in place.

To protect workers, visitors and customers, businesses must make sure they have put measures in place and everyone is following them to manage the risk from coronavirus.

HSE will be calling and visiting businesses from all different sectors in the area to check they are following the government guidelines, this will be starting on Monday 22 March.

These inspections will focus on office workspaces in the centre of Manchester. HSE will work alongside local authority health and safety officers, to effectively assess the COVID-secure measures in place to protect workers.

Manchester City Councillor, Councillor Bev Craig, Executive Member for Adult Health and Wellbeing, said: “We will be talking to local businesses and visiting and inspecting sites across Manchester to understand how they are managing risks in line with their specific business activity.

“All business should have COVID-secure measures in place. It is a legal duty for businesses to protect their workers and others from harm and this includes taking reasonable steps to control the risk and protect people from coronavirus.

“This means making business adjustments to be COVID-secure. We advise employers to work with their employees when implementing changes, to help increase confidence with workers, customers and the local community.

“As changes come throughout the next few months and businesses reopen, our responsibility is to make sure that all measures continue to be taken to keep workers safe as they return to the workplace. Following the government roadmap, we can see how Manchester can and will reopen safely.”

Being COVID-secure means businesses need to keep up-to-date with the latest guidance and put measures in place to manage the risk and protect workers, visitors and customers.

During the calls and visits, HSE provides advice and guidance, but where businesses are not managing the risk, immediate action will be taken.

Angela Storey, Director of Transformation and Operational Services at HSE, said: “Across the country we are working with local authorities, like Manchester City Council, to check businesses are COVID-secure and providing guidance and advice where needed.

“Our spot checks and inspections support the cross-government work in helping employers and employees at work during the pandemic.

“All workplaces are in scope for spot checks which means businesses of any size, in any sector can receive an unannounced check from HSE or an inspection from the local authority, to check they are COVID-secure.

“If you are contacted by the HSE or your local authority, please engage with us.

“By making sure that businesses have measures in place to manage the risks, we can benefit the health of local communities as well as support the local and national UK economy.”

Please ensure your workplace is safe by following the guidance on being COVID-secure. Further information on spot checks and inspections is available on our website.

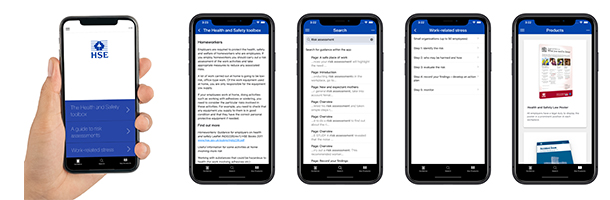

The Official HSE Health and Safety app for SMEs

Guidance at your fingertips

The Health and Safety Executive (HSE) are delighted to announce the release of a bespoke mobile app, designed to help organisations understand the law, their health and safety rights, and their responsibilities.

HSE's mission is to prevent death, injury and ill-health in Great Britain's workplaces. Ensuring that guidance is available and accessible in a variety of formats is central to achieving this objective.

Created in partnership with The Stationery Office (TSO), the app is primarily for small and medium sized businesses to help them better understand the law and what is required to protect employees.

The app is now available as a 'public beta' and can be downloaded on your Apple or Android device from either the iOS or Google Play Store.

What does the HSE app include?

The app contains three main sections:

How do I download the HSE app?

The HSE health and safety app is now available to downloaded as a one-off introductory rate of only £2.99 from the Apple iOS store and the Google Play Store.

Use the links below to download on your device:

Business rates relief boosted with new £1.5 billion pot

Business ratepayers adversely affected by COVID-19 are to get a £1.5 billion discount on their bills.

- new Business Rates relief fund of £1.5 billion for businesses affected by COVID-19 outside the retail, hospitality, and leisure sectors

- targeted support delivered as appeals against rates bills on basis of material changes of circumstance due to the pandemic to be ruled out

- the relief fund will get cash to affected businesses in the most proportionate and equitable way

Ministers have today set out plans to provide an extra, targeted support package for businesses who have been unable to benefit from the existing £16 billion business rates relief for retail, hospitality and leisure businesses. Retail, hospitality and leisure businesses have not been paying any rates during the pandemic, as part of a 15 month-long relief which runs to the end of June this year.

Many of those ineligible for reliefs have been appealing for discounts on their rates bills, arguing the pandemic represented a ‘material change of circumstance’ (MCC).

The government is making clear today that market-wide economic changes to property values, such as from COVID-19, can only be properly considered at general rates revaluations, and will therefore be legislating to rule out COVID-19 related MCC appeals.

Instead the government will provide a £1.5 billion pot across the country that will be distributed according to which sectors have suffered most economically, rather than on the basis of falls in property values, ensuring the support is provided to businesses in England in the fastest and fairest way possible.

Allowing business rates appeals on the basis of a ‘material change in circumstances’ could have led to significant amounts of taxpayer support going to businesses who have been able to operate normally throughout the pandemic and disproportionately benefitting particular regions like London.

Chancellor of the Exchequer Rishi Sunak said:

Our priority throughout this crisis has been to protect jobs and livelihoods. Providing this extra support will get cash to businesses who need it most, quickly and fairly.

By providing more targeted support than the business rates appeals system, our approach will help protect and support jobs in businesses across the country, providing a further boost as we reopen the economy, emerge from this crisis, and build back better.

Secretary of State at the Ministry for Housing, Communities and Local Government Robert Jenrick said:

Throughout the pandemic we have provided unprecedented support to businesses. Today are going even further with an extra £1.5 billion for councils to provide additional targeted support to those businesses that have not already received rate relief. This is the fastest and fairest way of getting support to businesses who need it the most.

We are also acting to ensure businesses have certainty over their bills and councils have certainty over their funding so they can continue to support their communities and deliver quality local services.

The £1.5 billion pot will be allocated to local authorities based on the stock of properties in the area whose sectors have been affected by COVID-19. Local Authorities will use their knowledge of local businesses and the local economy to make awards.

We’ll work with and support local government to enable ratepayers to apply as soon as possible this year, once the legislation relating to MCC provisions has passed and local authorities have set up local relief schemes. By contrast, individual appeals based on MCCs could have taken years to resolve in some cases.

Around 170,000 businesses have made claims for MCCs. Initial claims were confined to a discrete cohort of properties and handled by the Valuation Office Agency, but claims multiplied as the pandemic and public health measures evolved. Covid restrictions have affected all or nearly all commercial properties in England – well beyond the scope of any previous application of the MCC provision.

A core principle of the business rates system is that economic factors are captured at revaluations, with the MCC system usually applying to issues such as physical changes to the property or surrounding area – for example significant roadworks near a property that affect its value.

Business rates are devolved so the devolved administrations in Scotland, Wales and Northern Ireland will receive an additional £285 million through the Barnett formula as a result of today’s announcement.

UAE and UK launch sovereign investment partnership with initial £1 billion in life sciences

Abu Dhabi’s Mubadala Investment Company to invest £800m, alongside £200m from the UK, boosting the next generation of British life science companies.

The Department for International Trade and the Prime Minister’s Office’s recently-established UK Office for Investment (OfI) and Abu Dhabi’s Mubadala Investment Company, one of the world’s leading sovereign investors, today signed a long-term investment agreement.

This is the first agreement of its kind for the UK and the Office for Investment and will deepen existing UK-UAE trade and investment ties that were worth £32 billion in 2019.

The UAE-UK Sovereign Investment Partnership (SIP) will serve as a coordinated investment framework to grow a future-focused relationship between the two nations, driving economic recovery, jobs and growth.

An initial £800m commitment from Mubadala to invest in UK life sciences over five years is the first focus for the SIP. The sum will be deployed alongside the UK’s £200m Life Sciences Investment Programme announced last year, a vital pool of patient capital for the sector that will enable more UK life sciences businesses to scale and grow. The OfI and Mubadala will work together to identify commercially viable opportunities for investment into the sector.

Combined, these funds will provide much needed stable investment into the next generation of life science companies around the country. The industry, which generates £80 billion turnover a year within the UK and employs more than 250,000 people, is expected to benefit from stronger links in life sciences research, education and closer ties between the UAE and UK.

Over a five-year period, the SIP will invest across several tech and innovation-led sectors such as energy transition and infrastructure that will support job creation in both nations, strengthen national research and development capabilities and develop new areas of investment collaboration.

Emissions-cutting trucks and next-gen hydrogen buses closer to hitting the road with £54 million government-led funding

Innovative green projects creating the next generation of electric trucks and hydrogen-powered buses are set to secure nearly 10,000 UK jobs and save millions of tonnes of carbon emissions.

£54 million for projects including motorsport technology in car motors, hydrogen fuel cells for buses, and lightweight structures for electric heavy goods

vehicles

projects in England, Wales and Northern Ireland will secure nearly 10,000 jobs and save 45 million tonnes of CO₂

investment will help drive energy-saving technology across a wide range of vehicles and propel forward a green economy recovery

Innovative green projects creating the next generation of electric trucks and hydrogen-powered buses are set to secure nearly 10,000 UK jobs and save millions of tonnes of carbon emissions, thanks to

over £54 million funding announced today (22 March) by Business Secretary Kwasi Kwarteng.

The 3 projects in Cwmbran, Warwickshire and Ballymena will receive more than £54 million of funding from UK government and industry and are forecast to secure nearly 10,000 jobs across the UK. They could also save 45 million tonnes of carbon emissions, equal to the total amount of emissions produced by 1.8 million cars over their lifetimes.

Investment in new technologies, including hydrogen fuel cells, will help cement the UK’s position as a global leader in automotive technology and support the country to build back better and greener from the pandemic by helping to meet the UK’s climate goals.

The 3 projects being funded today are:

£31.9 million to develop electric propulsion systems for heavy goods vehicles in Cwmbran, Wales. This technology could be applied in a range of ways, such as giving

lorries greater travel range and better energy efficiency for coaches and construction vehicles

£11.3 million to develop and manufacture energy-saving technology from motorsport for use in cars and vans from a centre in Warwickshire

£11.2 million to develop and manufacture low-cost hydrogen fuel cell technology for buses and create a hydrogen centre of excellence with Wrightbus in Ballymena, Northern Ireland

Business Secretary Kwasi Kwarteng said:

The UK is leading the world by developing cutting edge technology that will help to tackle climate change and lead to a green, competitive future for our automotive supply chain.

These projects will not only help accelerate the wider application of greener technology in lorries and buses, but will also help generate the high-skilled jobs to level up communities across the UK while ensuring we build back greener from the pandemic.

This funding announcement builds on the recent launch of the government’s national Bus Back Better strategy and the Prime Minister’s 10 Point Plan for a Green Industrial Revolution, both of which aim to accelerate the shift to zero emission vehicles and decarbonise the UK’s transport networks.

Transport Minister Rachel Maclean said:

As we look to reduce our carbon emissions, strive towards our net-zero goals and level up right across the UK, the whole transport sector will need to embrace new innovative technology such as green hydrogen and these projects are a fantastic example of doing just that.

I’m proud to see the UK leading the way in the global transition to zero-emission vehicles. In the next decade, we’ll continue to be at the forefront of their design, manufacture and use as we build back greener.

Secretary of State for Northern Ireland, Brandon Lewis said:

Northern Ireland and the local economy thrives on innovation, manufacturing and technological advancements, leading the charge in allowing us to reach our ambitious goal of a net zero future by 2050.

With a landmark investment of £11.2 million this will enable Wrightbus to become a centre of excellence for zero-emission technology in the heart of Ballymena.

This is outstanding news for the people of Northern Ireland, protecting more than 1,000 skilled jobs and creating more than 3,000 additional jobs over the next 10 years. This will continue to level up our local economy, allowing Wrightbus to continue producing the next generation of world-leading hydrogen buses.

Secretary of State for Wales, Simon Hart said:

As we work towards net zero by 2050, South Wales will be a hub of innovation and green technology as we transform the UK economy over the coming years.

The investment in electric propulsion systems in Cwmbran will create more than 1,000 skilled jobs. It follows recent UK government backing for the Global Centre of Rail Excellence and to develop a net zero industrial zone across South Wales as we ensure that the region’s proud heritage is continued with the industries of the future.

CEO at the Advanced Propulsion Centre Ian Constance said:

We are delighted to have guided the latest investment of more than £54 million in the development and production of innovative powertrains to further accelerate the transition of the automotive sector to a net-zero future. The funding will enable the UK to apply its world-class innovation and experience in electrification of vehicles across the supply chain in Great Britain and Northern Ireland.

From fuel cell technology for buses, designed and built in Ballymena, a lightweight electric powertrain for commercial vehicles developed and manufactured in Wales and an integrated motor and energy recovery systems system for cars and vans based on motorsport technology in Warwickshire, today’s announcement secures and creates nearly 10,000 jobs and will cut CO2 emissions equivalent to removing the lifetime emissions of nearly 1.8 million cars.

By investing in new, greener technology for the UK automotive sector, funding of this kind will help realise the government’s ambition for the UK to end its contribution to climate change by 2050.

Councils given power to build more homes for first time buyers and for social rent

Councils in England will have more freedom on how they spend the money from homes sold through Right to Buy to help them build the homes needed in their communities.

- Councils will be given more freedom on how they spend the money they receive from selling homes through Right to Buy

- Councils can spend that money on building homes for shared ownership, First Homes and housing at affordable and social rent

Councils in England will have more freedom on how they spend the money from homes sold through Right to Buy (the sale of a council house), to help them build the homes needed in their communities, under reforms announced today (20 March 2021) by Housing Secretary Rt Hon Robert Jenrick MP.Today’s package will make it easier for councils to fund homes using Right to Buy receipts, including homes for social rent, and give them greater flexibility over the types of homes they provide to reflect the needs of their communities.

It will also give councils more time to use receipts and to develop ambitious building programmes. The government wants homes supplied using Right to Buy receipts to be the best value for money, and to add to overall housing supply, to help towards delivering 300,000 new homes a year across England by the mid-2020s. This set of reforms, combined with the abolition of the borrowing cap in 2018, gives councils substantially increased flexibilities to build the homes England needs.

These changes take effect from 1 April 2021, with the exception of a new acquisition cap, which will be introduced from 1 April 2022, on a phased basis.

Housing Secretary Rt Hon Robert Jenrick MP said:

Councils have a crucial role to play in increasing housing supply, including building more affordable and social housing.I have listened to local authorities who responded to our consultation on the use of Right to Buy receipts and I am delighted to announce a package of reforms providing authorities with the flexibilities they need to develop ambitious build programmes and help get people on the housing ladder.

Cllr James Jamieson, Local Government Association Chairman, said:

The LGA has long-called for reform to Right to Buy and we are pleased government has engaged with us and acted on councils’ concerns.Extending the time limit for spending Right to Buy receipts and increasing the proportion of a new home that councils can fund using receipts will boost councils’ ability to build desperately-needed affordable housing for local communities.We now look forward to working with government to implement these reforms and it is good it will work through any specific local challenges some councils may face as a result of the acquisitions cap.

Health and safety statistics

Key figures for Great Britain (2019/20)

- 1.6 million working people suffering from a work-related illness

- 2,446 mesothelioma deaths due to past asbestos exposures (2018)

- 111 workers killed at work

- 693,000 working people sustain an injury at work according to the Labour Force Survey

- 65,427 injuries to employees reported under RIDDOR

- 38.8 million working days lost due to work-related illness and workplace injury

- £16.2 billion estimated cost of injuries and ill health from current working conditions (2018/19)

Extra £47.6 million for Vaccines Manufacturing and Innovation Centre

The VMIC will be the UK’s first national vaccines manufacturing and innovation facility and will be able to respond to pandemics by producing millions of doses quickly.

The funding will support work already underway to:

-

expand the capacity twenty-fold so that the UK has a highly specialist manufacturing centre that, in a pandemic situation, can make up to 70 million doses within a 6 month period

-

accelerate the timeline for VMIC to be operationally ready so it can support the national response to (coronavirus) COVID-19

VMIC has been granted almost £215 million of government funding in total to date.

In May 2020, the government confirmed additional funding of £93 million to the VMIC - which was first announced in 2018 - to expand and fast track the project. The new £47.6 million is in addition to this funding and will support the delivery of this highly specialist facility during these unprecedented, challenging times.

Through the VMIC, the government also invested £8.75 million in the set-up of a rapid deployment facility at Oxford Biomedica in Oxfordshire, which was a major milestone in increasing UK manufacturing capability of viral vector vaccines. By October 2020, these 2 additional manufacturing sites were approved by the Medicines and Healthcare Products Regulatory Agency, and are currently producing the Oxford University/AstraZeneca vaccine.

H&S after Brexit

|

|

|

|

HMRC warning over Class 2 NI

|

|

|

|

VAT: domestic reverse charge for building and construction services